Case Study: Fidelity

Fractional tradeRole: Principal Designer

Do customers understand trading by the slice?Fidelity's independent investors use the Flagship Mobile app to monitor and trade securities.

Fractional trades were being discussed as a way of allowing novice traders dip their toes into blue chip stocks with high prices.

The Fidelity mobile app’s trade flow is the most used in the personal investing business and generates the most revenue. Changes to the mobile trade experience have implications for both experienced and non-experienced so even minor details are scrutinized.

We knew that Robinhood and other players were going to launch a way to trade stocks by the dollar. Our system had the facility to do that already for our back end-systems. Our goal was to make it to market faster than our competitors.

Using the same criteria, there were two streams of research that determined our direction. A simplified trade experience would lead heavier hand-holding for users who were unfamiliar with trading whereas our current experience was more familiar to more experienced users of our existing system.

I was able to convince the business to allow research by promising to design the MVP in parallel and get it released. There were also unknowns about non-customers and their ability to understand our systems, which were validated with research.

- Low net worth Fidelity customer

- Low net worth non-customers

- High net worth Fidelity customer

- High net worth non-customers

- Quantitative research to determine which of the user types we would target. Our research team handled this. Their results showed similarly to my own but I can’t speak to the methodology or data.

- Qualitative research – I created the screens and ran a series of tests across the four segments using User Testing. I was one of a few designers who took an internal course held by research and deputized to run tests without oversight on the condition that we use self-moderated tests on prototypes.

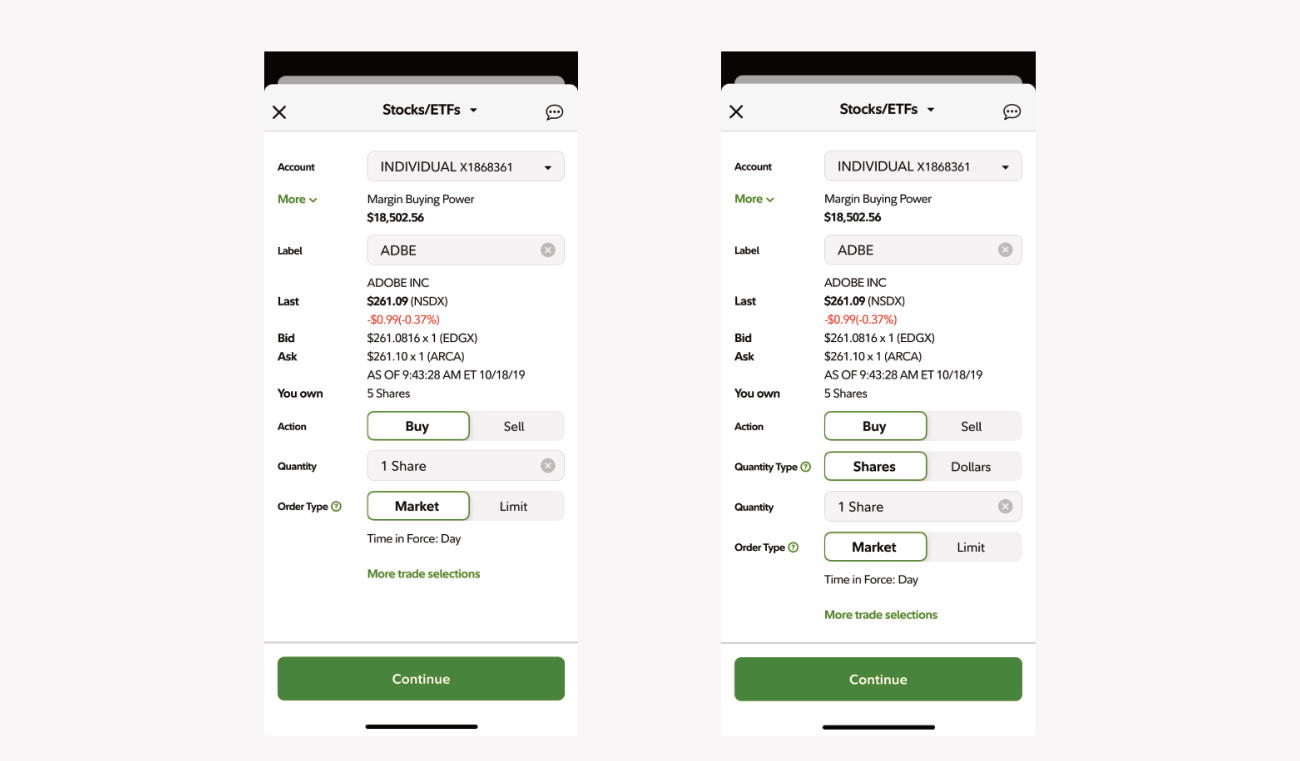

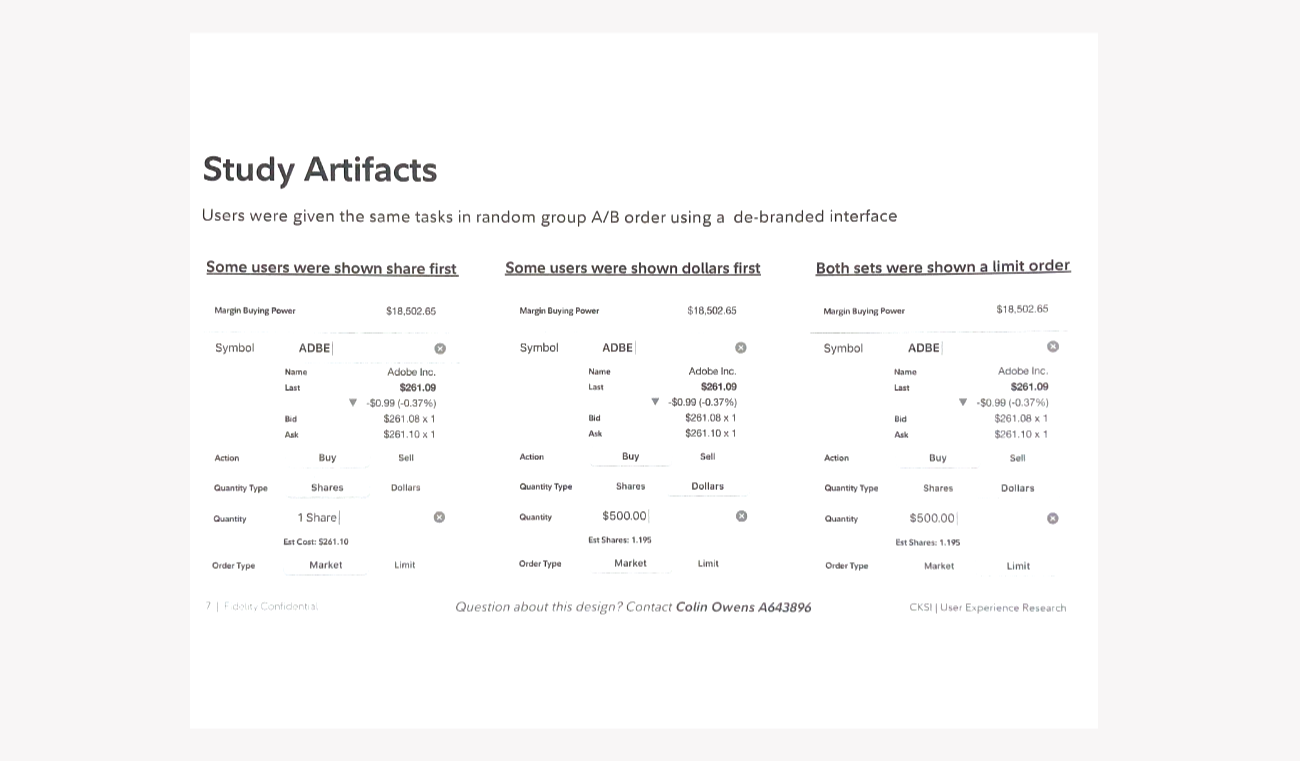

- A trade screen with the shares selection preselected

- A trade screen with the dollars selection preselected

In addition I added additional example data about margin trading and asked users about creating limits on trades to figure out the level of experience each user had with trading in general.

These were my hypotheses going into the research:

- Participants will most likely understand buying fractions of trades

- Some participants may get confused about limits set to dollar / fraction trade amounts

- Prospects will understand the basic functionality of the trade ticket

Some existing customers didn’t understand the relationship between dollars and limits. This was a valid concern, considering limits are normally applied to share price. Absent a clear label for share price in addition to the dollar amount could cause confusion. We ensured one would be present for launch.

General interest was high with non-customers and lower amongst high net worth customers.

We released and increase profit by $2mm per day and added a large number of customers. Some of this was as a result of Robinhood’s inability to fill orders and we were ready when the customers came.

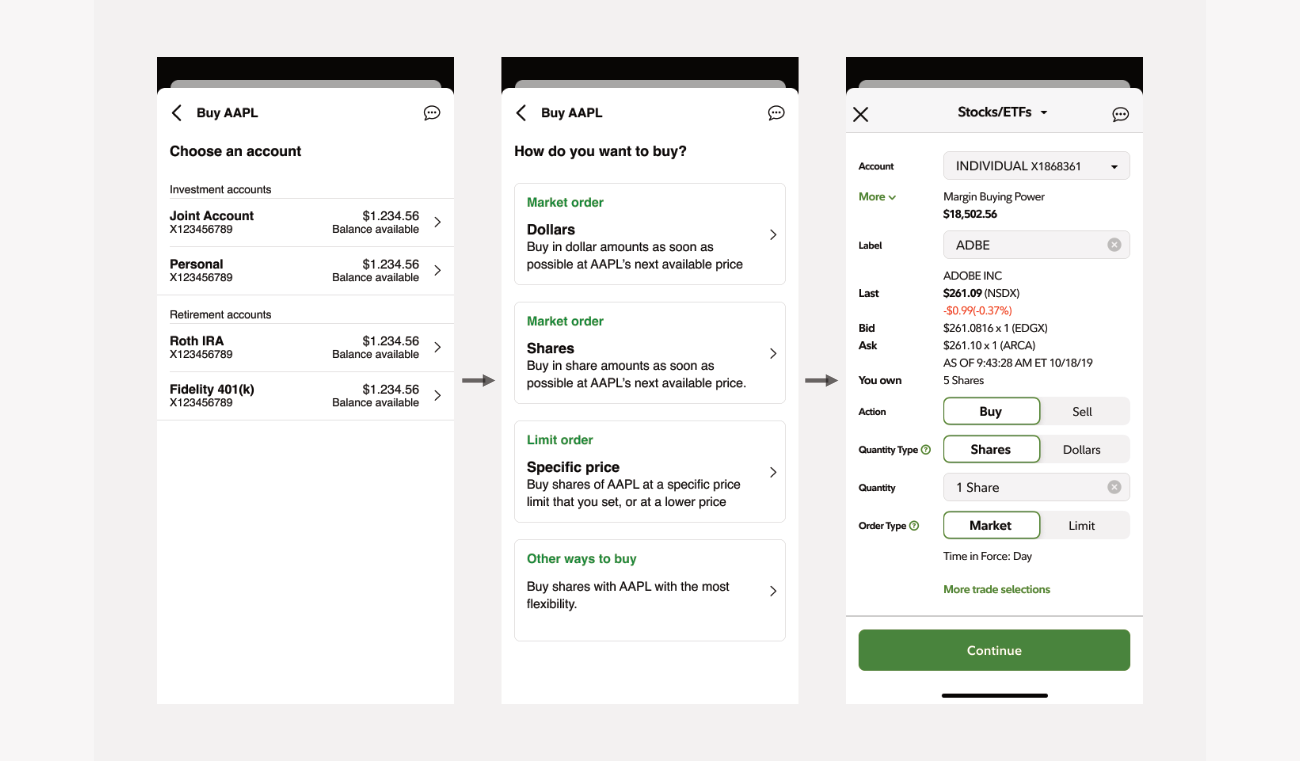

Subsequent to the release we created simplified flows that included the full trade experience, but also added quick market trades and separate flows for limit market trades.

This was anchored by a decider view that allowed us to customize trades and types based on a customer’s level within our line of business.

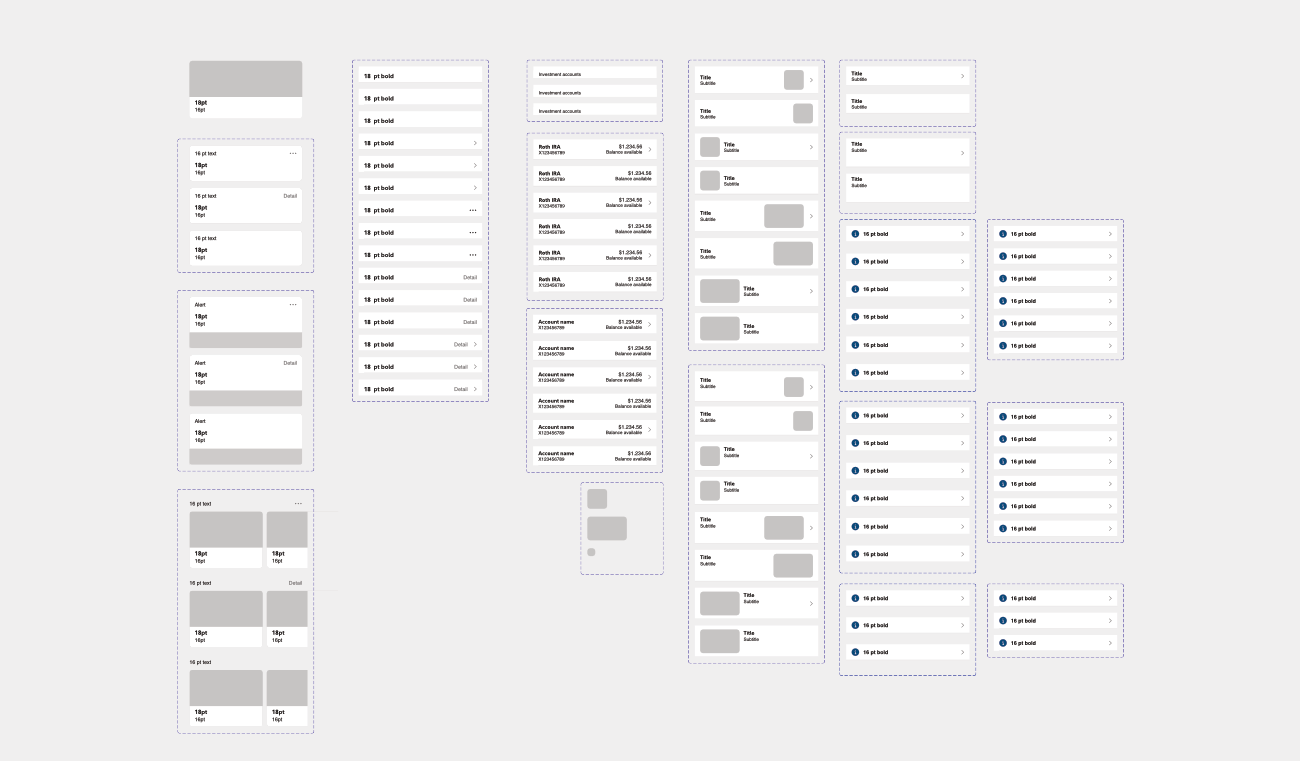

In addition, a lot of work was done to elevate the design and develop in a more holistic and “systems” way. I contributed a lot to the effort by introducing dark mode, tokenized colors, fonts and spacing and templates for different patterns and interactions.